It was great to be invited as a Keynote speaker today and to share my research and views on how Customer Experience and customer expectations is driving the future of AI in Banking at Group Futurista’s Future of Chatbots and Conversational AI webinar.

How will conversational AI power tomorrow’s Bank?

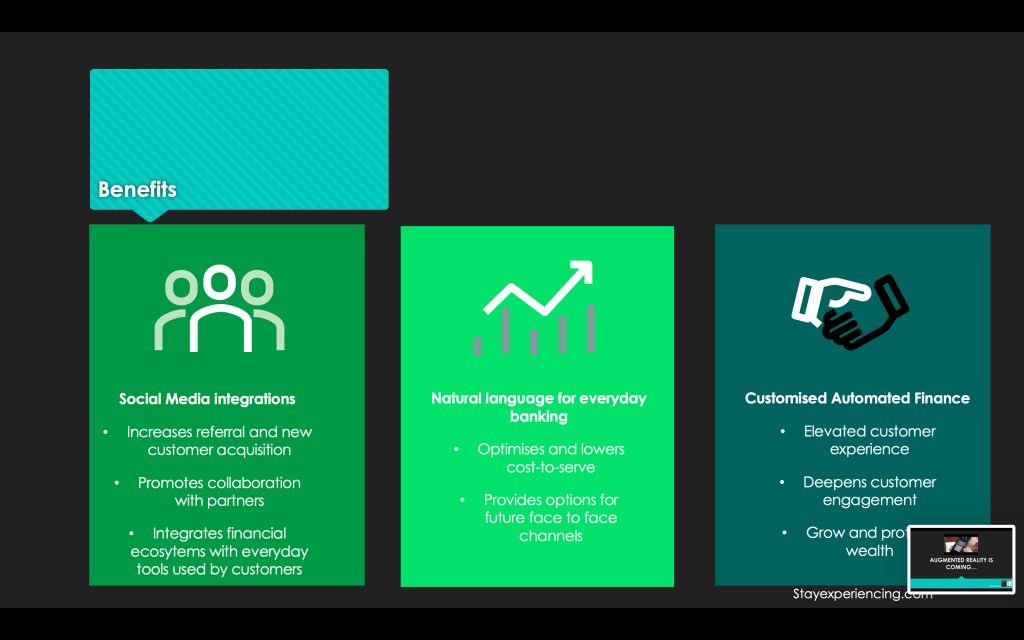

- Customer behaviour is influencing how conversational AI will power the banking industry.

- Integration with social media

- Easier everyday banking

- Customised banking innovations

- Today AI is predominantly being used in 3 areas of Banking

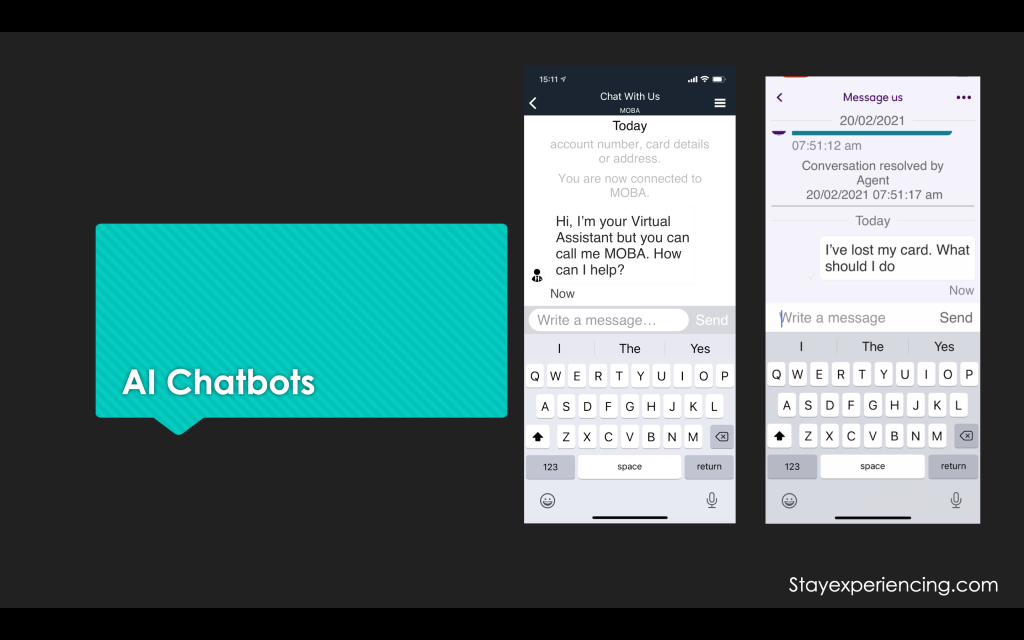

- Chatbots

- Robo Advice

- Cybersecurity & Fraud detection

- In Banking today, primary use case for AI is Chatbots, however AI product vendors offerings in this area is lowest in comparison to offerings on the market for risk related functions

- Signalling that chatbot as primary customer service tool in the AI field may soon be a thing of the past

What is the future of AI for Banks?

Customer research and customer behaviour is pointing in the direction of Voice being the new disruptive area for conversational AI in Banking.

- Voice is part of a broad and ongoing quest for more Natural User Interfaces or NUIs. Voice technology has been around for a while but with the growing use of sophisticated AI techniques is now moving into a new era — real time “conversation”.

- Conversational AI is an area of growing interest among investors and corporations alike and is fuelling acquisition plays. Apple acquired ‘Pullstring’ a marketplace for voice-app developers; tech giants Microsoft and SAP have each also acquired Conversational AI companies in the last year.

- Over 50 Conversational AI startups formed in the last five years making them a new era of startups that are growing rapidly.

3 ways customer behaviour will influence conversational AI that Banks can learn from

- Through integration with Social Media: Whatsapp is a great example of the correlation between social media and how it can reset customer behaviours and expectations. Clubhouse is another one to watch. So for those of you not yet on Clubhouse and don’t know what it is let me quickly tell you. Clubhouse is a social networking apps based on audio-chat. It allows you to listen in to conversations, interviews and discussions between influencers in different industries on various topics – it’s like a live podcast and with an added layer of exclusivity because it’s invite only – Real virtual world elitism! Now much like Whatsapp and WeChat changed the game on how customers expect to be serviced. .. I believe social media apps like clubhouse will set the same precedent. For example, we know financial services ecosystems are emerging in Asia. WeChat is similar to Whatsapp and some financial companies are able to layer their banking apps on top of existing tech platforms like Wechat. WeChat then connects customer data with the bank allowing customers to transact within the app itself. If voice based apps like clubhouse continue to gain momentum and popularity in moving users away from text based interactions to voice based interactions, then expect banks to follow suit at a later date!

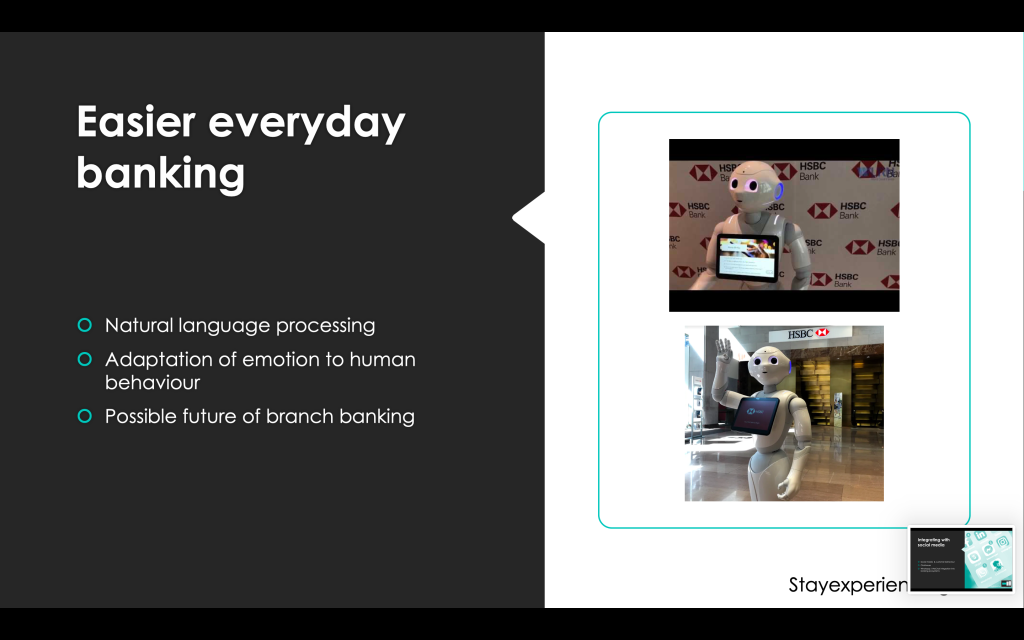

- Through easier everyday banking: This is where conversational AI has the power to drive the future of banking most rapidly. Natural language processing, a component of artificial intelligence, to understand multiple languages and accents is an interesting use case. Let’s take The SoftBank robot named pepper which has been used at HSBC. Pepper is capable of recognising basic human emotions and adapting its behaviour accordingly. Over the last 5 years myself and others in the banking industry have been talking more and more about the future of branches. Even more so now as we move to a Post Covid era. How do we make our branches more relevant in a safe, yet engaging way? Could innovations for everyday banking like Pepper be the way forward? In some ways Pepper functions like a human concierge. It asks what the person needs help with and will communicate directly with branch staff to route the costumer to the appropriate person. Pepper has helped reduce waiting times and freed up our branch staff who don’t have to explain basic product features but can now offer more high value services like mortgage appointments or one-on-one financial reviews. So in conclusion helping with everyday banking, in the form of concierge services via a natural language robot like pepper could be another way AI can power the future of Banking.

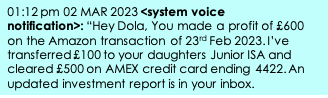

- Through customised Banking innovations: Part of my remit in my day to day working life is initiating and observing customer testing. Whenever I’ve put early prototypes of financial advise products in front of our customers, some of the feedback I often receive is that it can feel really generic and impersonal. It also tends to be overly reliant on subjective advice rather than personal to the customer because the product and customer information needed to improve it can be hard to pull together, both within the bank (silo’s) and across different institutions. Self-driving finance is a reimagined experience where customers can interact with an AI-based voice assistant for advice. The self-driving finance assistant is built to offer guidance on complex decisions like retirement planning, but at the same time, can automate routine transactions such as bill payment and purchases. The bank can identify how much savings a customer can make and essentially automate day to day financial decisions based on predicted cash flow for the individual and move the money to accounts or to make purchases on behalf of the customer. This is starting to take shape already and what you’ll see is sections within mobile apps title ‘insight’ or ‘insight hubs’. Essentially delivering personalised AI-driven insights and suggestions to users. Santander has a version of this called ‘My Money Manager’ integrated into their UK mobile banking app. Within that section you’ll get financial tips, nudges and personalised insights into your spending and any upcoming financial commitments which are sent via push notifications and what they call an ‘insight inbox.’ HSBC have also started on this journey, with the firsts iteration being that they allow customers to see their ‘balance after bills’ based on upcoming future payments such as direct debits and standing orders. However, both these examples are text based and only scratch the surface. The power behind this is the customisation and the ability for system voice notifications rather than text based push notifications to notify customers of more complex automations that have been made on their behalf. To bring it to life, pretend I am the AI voice assistant or an Alexa! As a customer I would have given my consent and should be able to say “whenever I have spare money laying around, other than what I need for day-to-day expenses, reinvest it into whatever earns the highest return.” What I may then get would be the following type of notification from the AI voice assistant:

So there you have it 3 ways that Conversational AI will power tomorrow’s Bank. We’ll see a move from text based conversational AI to voice based AI:

- Social media and customer behaviour will be a driving force

- The use of natural language processing will lead to more convenient and simpler ways to conduct your everyday banking and lastly

- This will open up opportunities in the self-driven automated finance field, which will use insights about you, your spending and goals to formulate personal advice and transact for the good of your financial wellbeing.